TAX TIP: Canada Learning Bond

The Canada Learning Bond provides money from the Government to help you start saving early for your child’s education after high school.

Your child could get $500 NOW to help you start saving early for your child’s education after high school, and an extra $100 each year up to age 15. That’s up to $2,000 (plus interest) in bonds for your child’s post-secondary education.

All you have to do is open a Registered Education Savings Plan (RESP) and you don’t have to put any of your own money into RESP to get the bond.

An extra $25 will be paid with the first $500 bond to help cover the cost of opening an RESP.

The bond can be used to pay for full- or part-time studies in an apprenticeship program, a CEGEP, trade school, college or university.

You are eligible for the program if your child was born after December 31, 2003, and you get the National Child Benefit Supplement as part of the Canada Child Tax Benefit, commonly known as “family allowance” or “baby bonus.”

It’s a simple 2-step process to apply.

1. Get a Social Insurance Number (SIN) for yourself and your child. There’s no fee. However, certain documents, such as a birth certificate, are required.

2. Open a Registered Education Savings Plan (RESP) account with an RESP provider that offers the Canada Learning Bond. Choose the RESP provider that best suits your needs and ask:

• if they offer the Canada Learning Bond and the Canada Education Savings Grant;

• what types of RESPs they offer (family, individual or group) and the advantages and risk factors of each;

• what investment products they offer and the advantages and risk factors of each; and

• what are their administration fees and penalties.

Remember, you don’t have to put money into the RESP. Your RESP provider will apply for the bond, which will be deposited directly into your child’s RESP account.

The Canada Learning Bond will not affect other Government of Canada benefits however it can only be used for post-secondary education. If your child does not continue their education after high school, the Government will take the Canada Learning Bond back.

For more information call 1 800 O-Canada (1-800-622-6232) or visit www.canlearn.ca.

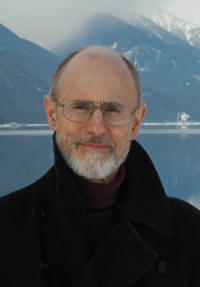

Alex Atamanenko is the MP for BC Southern Interior.

Comments