COMMENT: FATCA

On Feb. 5th the Canadian government signed an Intergovernmental Agreement (IGA) with the United States to govern The Foreign Account Tax Compliance Act (FATCA).

FATCA is an American tax law requiring all Canadian financial institutions to provide the U.S. Internal Revenue Service (IRS) with account information on customers who are deemed to be “U.S. Persons.”

The stated intention of FATCA is to catch U.S. citizens evading U.S. tax by hiding cash in “overseas” accounts. Even though higher taxes in Canada make it an unlikely tax haven, ordinary Canadians with chequing and savings accounts are being treated as “tax cheats” by the IRS.

“U.S. Persons” are not just U.S. citizens resident in Canada. They include Canadian citizens who emigrated from the U.S., children (and in some cases grandchildren) born in Canada having a single U.S. parent and the children of Canadian citizens born while in the U.S.

Also considered “U.S. Persons” for financial reporting purposes:

- Canadians who hold green cards

- Canadian citizens who share accounts, investments or property with an American spouse

- some Canadian “snowbirds”

- Canadian trusts with a “U.S. Person” who has signing authority

- small family owned businesses in Canada with a U.S. family member

- Canadian corporations and businesses with as few as one “U.S. Person” with signing authority (can you see the potential for discrimination in promoting Canadians?)

The IGA gets around banking privacy laws by shifting the responsibility for reporting to the Canada Revenue Agency.

Canada Revenue will collect account information from Canadian financial institutions, beginning July 1, 2014, and then share it with the IRS in 2015 under the terms of a pre-existing tax treaty.

The IGA further protects banks from the American threat of 30% withholding on their business in the States. But it does not protect more than a million Canadians from the effects of American tax laws.

FATCA and FBAR (Report of Bank and Financial Accounts) reporting is intrusive and far reaching for affected Canadians as the integrity of both their confidential information and their retirement security is put at risk.

Consider the implications for those Canadians deemed “U.S. Persons” and for the Canadian economy of the following:

- savings and investments of more than $200,000 ($400,000 for couples) must be reported to the IRS

- homes valued at more than $250,000 are considered foreign investment and are liable for U.S. capital gains tax on the appreciated value when sold

- possible double taxation on wills and estates

- higher Canadian tax (financial planners advise clients to divest themselves of Canadian mutual funds and direct their investments to U.S. sources).

- annual reporting requirements are complex and expensive – even when no taxes are owed, legal and accounting fees can amount to thousands

- erosion of the tax base in Canada as investments and retirement security funds shrink

Failure to comply with FATCA or FBAR reporting, or failure to comply on time, carries severe cash penalties and/or criminal charges.

Now the U.S. government has added a new filing requirement. As of 2013 all FBAR reporting must be done electronically. Even individuals who owe no tax and are fully compliant with all the IRS requirements are now forced to file on-line through the U.S. Treasury’s Financial Crimes Enforcement Network.

All Canadian citizens should be entitled to the same rights of citizenship, including the constitutional rights to privacy and fair taxation.

Instead many Canadians face the violation of their financial privacy, unfair taxation on Canadian assets and branding as criminals. This new tax treaty with the United States will protect Canadian banks but does little to protect Canadian citizens. There is nothing fair about FATCA.

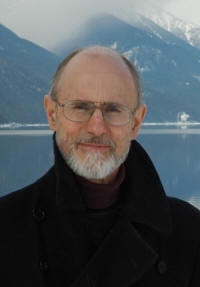

Comments