Practical Financial Solutions: Planning for blended families

Blended families are becoming the national norm.

Finances are challenging for any relationship and they become even more challenging in the case of multiple marriages or common-law relationships, especially when they include children from previous and current relationships.

If yours is a blended family, here is some basic financial advice you should consider:

- It’s important that both partners come together and develop a cohesive plan that will help best attain your new family’s objectives.

- Determine how you are going to treat all your children equally, in the longer term as well as how you are going to deal with your kids’ money on a day-to-day basis.

- Establish a RESP for every child that does not already have one.

- If you and your partner designate each other as the direct beneficiary of all of your assets, when one partner dies, everything goes to the survivor, potentially disinheriting the children of the deceased partner. If the surviving partner should remarry, the new partner could become entitled to the estate (or a large portion of it) which could disinherit not only the children of the deceased partner but even the children of the survivor. For these and other reasons, a standard will is not recommended for a blended family. Other strategies include dividing the estate at the time of death of the first parent or using a spousal trust to protect the assets for both families. It’s crucial to speak to your legal advisor regarding a will with terms appropriate for your blended family.

- Similar problems can arise from jointly held property. Many couples choose to hold property jointly so title passes automatically to the survivor on the death of the spouse and avoids probate fees (this does not apply in Québec). But if you have children or other dependants from a previous relationship and want them to share in the value of your property, then holding title to the property jointly with the right of survivorship isn’t recommended. Speak to your legal advisors regarding ways to hold title to property in a way that benefits your children and carries out your wishes.

- Financial and estate planning for blended families can be more complicated than with traditional families. Work with your professional advisor to develop the right strategies for your personal situation.

Your professional advisor will help you establish a planned giving strategy that makes the most of your philanthropy for your charities and for you.

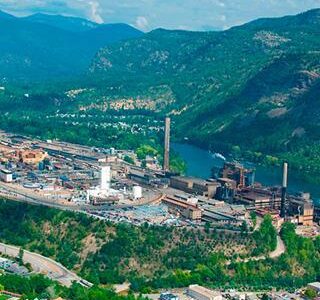

This column is sponsored by Roger Higgins, a BA, CFP Division Director for Investors Group in the Kootenays. For all your financial planning needs, contact Roger at 250-352-7777 of email at roger.higgins@investorsgroup.com

Story originated at The Nelson Daily

Comments