Stats Can data shows rental housing costs are pushing renters into crisis level spending

Nearly half of Canadian renter households are spending more than the recommended 30 per cent of their income on housing while nearly one in five are spending more than 50 per cent of their income on housing, putting a growing number of families and individuals at a crisis level of spending and at risk of homelessness.

The information comes from the 2018 Canadian Rental Housing Index, a comprehensive database of rental housing statistics released today by a national partnership of housing associations, credit unions, and municipal associations, developed using the latest census data from Statistics Canada.

The Index tracks everything from average rental costs, to how rental housing spending compares with income, to overcrowding for over 800 cities and regions through an easy to access web portal. The tool is designed for governments, local planners, housing organizations, and the general public to view an accurate picture of the rental housing market in communities across the country.

“Traditionally, spending 30 per cent or less of household income on rent has been viewed as the benchmark of what is considered affordable,” said Jill Atkey, Acting CEO of the BC Non-Profit Housing Association. “However, the data shows that spending more than 30 per cent of income on housing has become the new normal for individuals and families in almost all areas of

Canada.”

The data paints a worrying picture for rental housing affordability across the country. Over 1.7 million renter households spend over the recommended affordability benchmark of 30 per cent of gross income on rent and utilities. Of those, 795,000 renter households spend over half of their income on housing costs.

“If every renter household that spent more than half of their income on housing costs lived in one place, it would be Canada’s fourth largest city,” said Kira Gerwing, Manager of Community Investment at Vancity credit union. “This shows why a strong community housing sector is absolutely necessary to deliver rental housing that people can afford.”

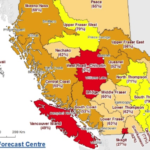

Another worrying trend is housing affordability issues continuing to spill into suburban and rural areas, rather than just large urban centres across the country.

“Although large urban centres have long been associated with higher rental housing costs relative to income levels, in the past, renters have been able to find suitable housing by looking in nearby suburban communities,” said Marlene Coffey, Executive Director of the Ontario Non- Profit Housing Association. “The 2018 Canadian Rental Housing Index shows the suburbanization of poverty where major affordability challenges are just as prevalent in the

surrounding communities as they are in those urban centres.”

The Index also shows that average rental costs are outpacing corresponding increases in household incomes. For example, Ontario saw average rent costs go up 20 per cent over five years compared with average income only rising by 12 percent over the same period. Regions

around Toronto, Ottawa, Winnipeg, and Vancouver have been particularly hard hit by this added affordability challenge, although many smaller communities are facing similar situations as well.

As affordability challenges continue to worsen, renter households are being forced into overcrowded and other unsuitable accommodations. In total, the 2018 Canadian Rental Housing Index shows more than 417,000 renter households in Canada are considered overcrowded. This remains a common issue for many renter households living in large urban centres and in Northern Canada.

One of the drivers of these affordability challenges is the increase in the number of Canadians in the rental market. Between 2011 and 2016, nearly 400,000 new renter households were added for a total of more than 4.4-million or 32 per cent of all households in Canada.

“With escalating prices keeping many Canadians from affording home ownership, as well as a lack of affordable rental housing supply, more people are entering the rental market or staying in the rental market longer,” said Jeff Morrison, Executive Director of the Canadian Housing and Renewal Association. “This marks the first time in a generation that the rate of Canadian renters has outpaced the number of Canadians buying a home, and speaks to the need to increase the supply of affordable housing.”

While the Index paints a negative picture for rental housing affordability across the country, an unprecedented focus on rental housing affordability by many governments and housing organizations provides hope for the future. Lessons can be learned from Quebec, which has better rental housing affordability relative to any other province or territory in the country.

“While still significant, affordability pressures in Quebec are less severe relative to other parts of the country, due in large part to a continuation of provincial affordable housing programs since the 1990s,” said Stéphan Corriveau, Executive Director of Réseau Québécois des OSBLd’habitation. “The Canadian Rental Housing Index demonstrates the need for all levels of government, communities, and housing providers to work together to ensure the timely delivery of a variety of housing options to address the diverse needs of Canadians.”

Comments