Interest rates, real estate price drops flatline and dip latest BC Assessment

Drooping real estate prices and high interest rates have pushed down the 2024 assessments for the West Kootenay region, meaning a smaller tax bill for some homeowners this year.

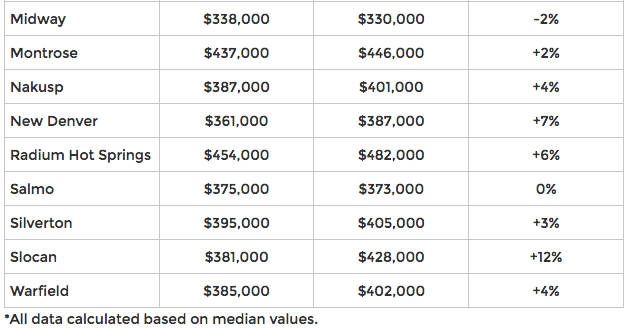

When people throughout the region receive their 2024 assessment notices — which reflect market value as of July 1, 2023 by BC Assessment — this month they should notice a dip of one per cent (Nelson, Castlegar) to a rise as much as 12 per cent (Slocan).

In Nelson, prices for the 2024 typical assessed value of a single family home lowered to $670,000 (from $674,000), while in Castlegar average assessments fell by $7,000 to $490,000 for 2024. In contrast, Trail’s average assessed value rose $2,000 to $352,000 but, even still, it remained one of the lowest assessments for the Kootenay-Columbia.

The most expensive assessment was the same as last year with Fernie at $848,000, while the lowest was Greenwood at $245,000. In the local West Kootenay region, Nelson was the highest at $670,000 while Trail was $352,000 at the other end of the spectrum.

According to a percentage change due to market in single family residential homes there were similar drops and rises, ranging from a drop of 1.9 per cent (Salmo) to rise of 11.4 per cent (Slocan).

The West Kootenay’s three major cities — Nelson (-1 per cent), Castlegar (-0.9 per cent) and Trail (-1.4 per cent) — all saw a drop in single family residential, with Nelson rural also sinking by -0.6 per cent.

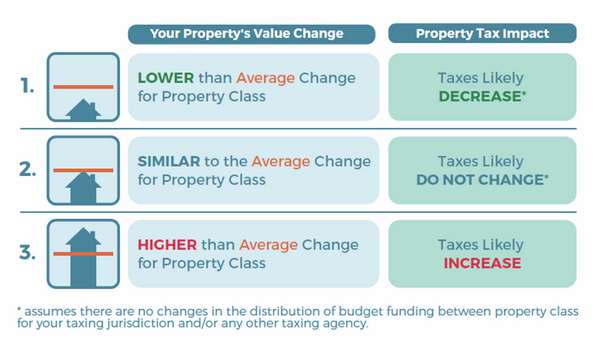

Although real estate sales determine a property’s value — reported annually by BC Assessment — local governments and other taxing authorities are responsible for property taxation and, after determining budget needs this spring, will calculate property tax rates based on the assessment roll for the jurisdiction.

“It is important to understand that changes in property assessments do not automatically translate into a corresponding change in property taxes,” said Southern Interior deputy assessor Boris Warkentin, in a press release. “As noted on your assessment notice, how your assessment changes relative to the average change in your community is what may affect your property taxes.”

The relative lack of change or regression in property values is due primarily to the Bank of Canada’s policy over the last two years of raising interest rates to slow the rate of inflation.

In November, the Association of Interior Realtors noted a 2.7 per cent decrease in the benchmark price for single-family homes in the Kootenay-Boundary region, coming in at $523,400. As well, unit sales saw a 13.6 per cent decrease compared to sales activity in November 2022 with 171 sales recorded in November 2023.

“While we typically do see market activity ease up as the weather cools, the high cost of borrowing seems to be propelling a speedier seasonal slowdown than usual,” said Association of Interior Realtors president Chelsea Mann last month. “The impact of qualifying for mortgages seems particularly impeding to rate-sensitive buyers as they struggle to secure financing.”

Mann said buyers and sellers are waiting despite high demand and hope there will be some interest rate relief coming.

There were also 239 new listings recorded in the Kootenay and Boundary region in November, marking a 7.4 per cent decrease compared to the same month last year.

Assessing the assessment

Assessments are the estimate of a property’s market value as of July 1, 2023 and physical condition as of Oct. 31, 2023.

“This common valuation date ensures there is an equitable property assessment base for property taxation,” said Warkentin.

Changes in property assessments reflect movement in the local real estate market and can vary greatly from property to property.

When estimating a property’s market value, BC Assessment’s appraisers use current sales in the area, as well as considering other characteristics such as size, age, quality, condition, view and location.

BC Assessment’s website at bcassessment.ca includes more details about 2024 assessments, property information and trends such as lists of 2024’s top valued residential properties across the province.

A second look

People who feel their property assessment did not reflect market value, or see incorrect information on the notice, could contact BC Assessment — as indicated on the notice — as soon as possible this month.

“If a property owner is still concerned about their assessment after speaking to one of our appraisers, they may submit a notice of complaint (appeal) by Jan. 31, for an independent review by a property assessment review panel,” said Warkentin.

The property assessment review panels, independent of BC Assessment, are appointed annually by the provincial government, and typically meet between Feb. 1 and March 15 to hear formal complaints.

Source: BC Assessment

Comments