Government delivers legislation to end the HST

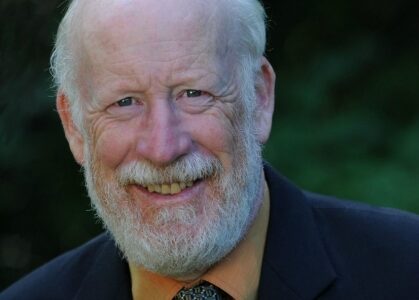

Finance Minister Kevin Falcon has introduced legislation to meet government’s commitment to return to the Provincial Sales Tax on April 1, 2013.

As committed, the PST is being re-implemented with all permanent exemptions. The government also introduced common-sense improvements that will make administration of the sales tax easier for businesses.

Consumers will pay PST only on those goods and services that were subject to the tax before July 1, 2010. Consumers will again not pay PST on purchases like food, restaurant meals, bicycles, gym memberships, movie tickets, and others, nor for personal services like haircuts.

“As promised, on April 1, 2013, consumers will only pay PST on those goods and services that were subject to PST before the implementation of the HST,” Minister of Finance and Deputy Premier Kevin Falcon explained.

“All permanent PST exemptions will be re-implemented, and consumers will not pay PST on food, bicycles, memberships, or personal services like haircuts and more.”

For businesses, the new legislation is clearer and easier to administer. The original provincial sales tax act was introduced in the 1940s, and countless changes were introduced over the years as adjustments were needed.

That approach created a complex and convoluted tax landscape for businesses trying to comply with the tax.

The new act will bring changes together in one statute that will be easier to follow, helping simplify business compliance and reduce costs. Improvements reflect recommendations from the business community and the Expert Panel on Business Taxation established in January.

New measures to improve the PST include:

- New online access for businesses, including the ability to register, update their account, and make payments.

- The due date for tax remittance and returns will be moved to the last day of the month to match GST remittance, simplifying administration for business.

- The Hotel Room Tax (eight per cent, as it was before July 2010) will now be incorporated into the PST-no more separate registration, remittance or returns, reducing paperwork.

- Businesses can register with their federal business number, making registration easier.

- Retailers will be allowed to refund tax to customers in a broader range of circumstances.

- Businesses that collect and remit tax will again receive commission of up to $198 per reporting period (typically monthly).

The Province also updated the Taxpayer Fairness and Service Code, first introduced in 2005.

The updated Taxpayer Fairness and Service Code reaffirms the government’s commitment to fairness and service values, and affirms taxpayers’ right to courtesy, respect, confidentiality, fair treatment, help, information, dispute resolution and timely appeals.

“The Taxpayer Fairness and Service Code demonstrates that this government is committed to taxpayer rights, fair dispute resolution and timely appeals,” Falcon said.

“With the reintroduction of the PST, we are refreshing the code and affirming our continuing commitment to fairness and service to taxpayers.”

Over the coming months, further work on regulations to fully establish the exemptions will continue and will consider the input received from business to ensure clarity. Additional consequential and transitional amendments will also be required before April 1, 2013.

The Province intends to publically release a final proposed version of the legislation as early as this fall to support business outreach and awareness.

By October 2012, government will begin outreach seminars to train businesses on how the PST applies, and business registration using the new online system will begin in January 2013.

As previously announced, the return to PST will also see:

- B.C. HST Credit eliminated.

- B.C. Sales Tax Credit re-implemented.

- Basic Personal Amount Tax Credit enhancement reversed.

- Tobacco Tax Rates adjusted to keep price levels consistent.

- Continuation at 12 per cent of the tax on private sales of vehicles, boats and aircraft.

- The PST rate of 10 per cent on liquor will be reinstated with the re-implementation of the PST. Liquor mark-ups will be reduced to generally keep shelf prices constant.

- The tax on propane will be re-implemented. The tax rate will be 2.7 cents per litre, the same rate as prior to the implementation of the HST.

Comments