Proposed sale of Elk Valley coal mines raises environmental concerns — Wildsight

Wildsight said that Teck’s proposed sale of its Elk Valley coal mines to Glencore, a large mining company with a poor environmental record, has environmental advocates concerned that the water pollution disaster in the Elk and Kootenay Rivers could get even worse.

In a media release, Wildsight, a non-profit organization based in the East Kootenay that focuses on initiatives that support environmental conservation, education, and regeneration, said the proposed sale should not proceed prior to the transboundary water pollution issue having been referred to the International Joint Commission (IJC).

This water pollution issue has demanded by the transboundary Ktunaxa Nation, Wildsight and others.

“We need the IJC to independently investigate the total extent of the pollution and the true costs for its complete remediation in the Elk-Kootenay river system,” states Randal Macnair, Wildsight Elk Valley Conservation Coordinator in the media release.

Last week Teck Resources Limited announced an agreement to sell its entire interest in its steelmaking coal business, Elk Valley Resources (“EVR”), through a sale of a majority stake to Glencore plc (“Glencore”) for an implied enterprise value of US$9.0 billion, and a sale of a minority stake to Nippon Steel Corporation (“NSC”).

Teck President and CEO Jonathan Price said the transaction will be a catalyst to re-focus Teck as a Canadian-based critical minerals champion with an extensive portfolio of copper growth projects, unlocking the full value potential of the company.

“This sale will ensure Teck is well-capitalized and able to realize value from our base metals business and deliver strong returns to our shareholders while maintaining a robust balance sheet.” Price said in a media release.

“Glencore has made strong commitments that will create new benefits for Canada and the Elk Valley and ensure responsible stewardship of the steelmaking coal operations for the long term.”

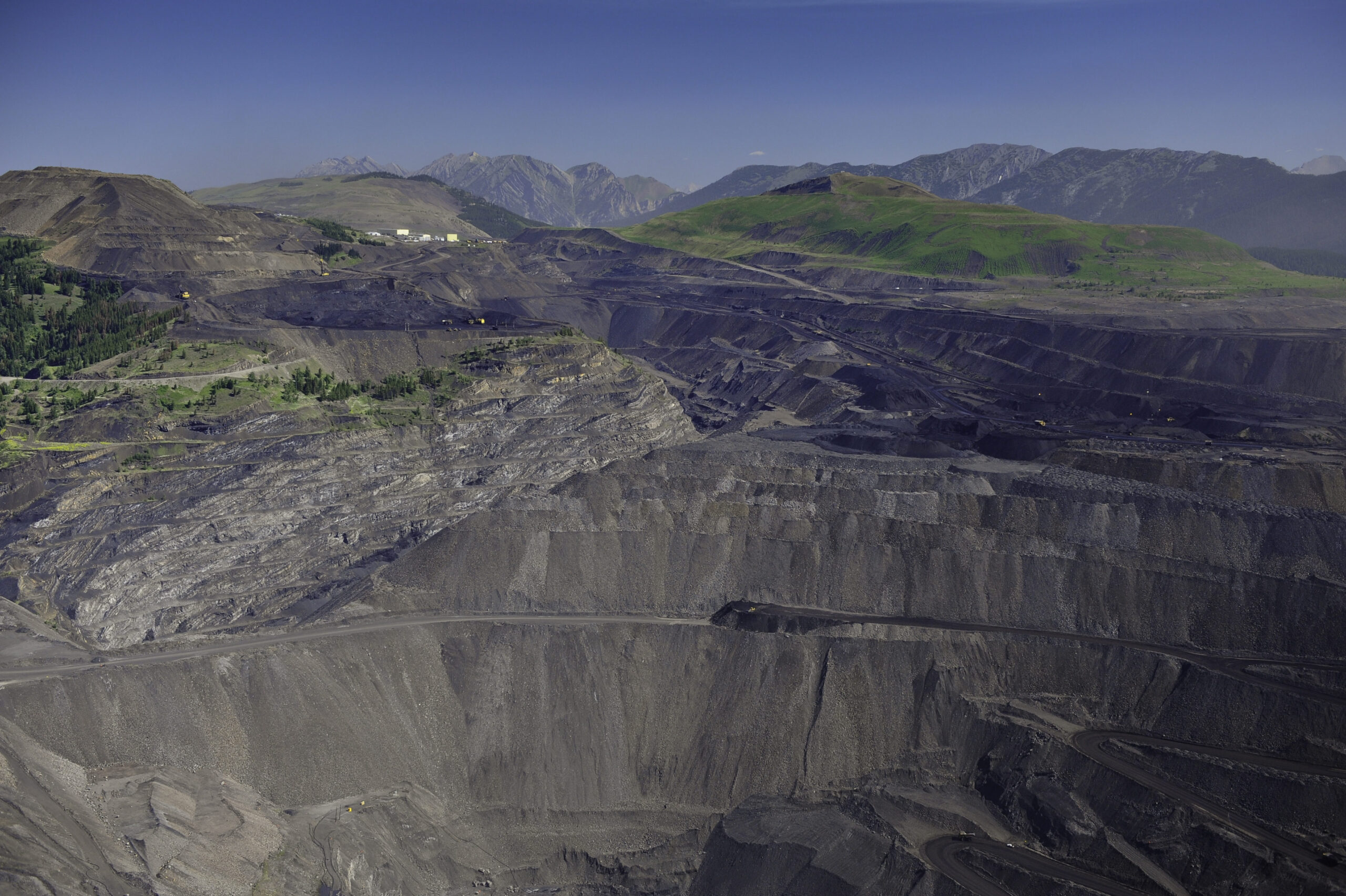

Wildsight claims for decades mountaintop removal coal mining has leached selenium, nitrates, sulphites and other pollutants into the Elk-Kootenay river system and Teck’s operations have damaged the environment and impacted sensitive animals like the westslope cutthroat trout.

In 2021, Teck was fined $60 million for polluting rivers and killing fish, the largest fine ever handed down for offences under the federal Fisheries Act.

Wildsight said that the Swiss mining company Glencore comes to the table with an even worse track record.

The Business & Human Rights Resource Centre said in a 2022 report that Glencore “has the worst human rights record among miners of metals used in renewable energy.”

Wildsight said that Glencore is the former owner of Montana’s Anaconda Aluminum Company, a Superfund site because of ongoing water pollution, the US government is spending tens of millions of dollars to clean up this industrial catastrophe.

“Allowing Glencore to take control of Teck’s coal mines could be disastrous,” says Mcnair.

“Fish populations have collapsed, municipal and other drinking water wells have been contaminated, and streambeds have been cemented with calcite with no end in sight. Shifting the ownership of these mines to a multinational mining company with a very poor environmental record could make things much worse.

“Money for cleanup must be a top priority before any transfer of ownership takes place. Adequate funds must be held to cover the costs of reclamation as well as water quality and environmental remediation so Canadian taxpayers aren’t left holding the bill of cleanup and the environmental cost isn’t ignored,” continues Macnair.

Wildsight said the reclamation bonds are estimated by mining companies as the amount needed to clean up a mine site.

BC usually requires these funds be held by the Ministry of Mines until the site is inspected and approved.

Currently, Glencore has not coughed up the money needed to reclaim three other BC mines under their ownership (Granisle property northwest of Prince George, Boss Mountain Mine east of Williams Lake and Brenda Mine west of Peachland). In total, Glencore is missing approximately $8.5 million from these reclamation bonds.

Meanwhile, while Teck has estimated $1.9 billion will be needed for reclamation in the Elk Valley, the company has not paid more than $400 million of that amount.

“Teck has already spent more than a billion dollars on water treatment that only handles a small portion of the water pollution coming from the mines,” says Macnair.

“The true cost to clean up and to treat the water flowing into the Elk River for centuries to come could easily be more than the $8.9 billion purchase price and will certainly be many multiples of the $150 million commitment to water quality Glencore has announced as part of the deal.”

Teck said the sale of Teck’s steelmaking coal business at the implied enterprise value of US$9.0 billion on a 100% basis achieves a simple and complete separation of steelmaking coal from base metals.

Glencore has agreed to acquire 77% of EVR for US$6.9 billion in cash, payable to Teck at closing of the Glencore transaction, subject to customary closing adjustments.

Teck said in the media release that proceeds from these transactions will help ensure Teck is well-capitalized to maintain investment grade credit metrics and to unlock the full potential of its base metals business. Uses of proceeds are expected to include improving Teck’s net leverage through debt reduction, the retention of additional cash on the balance sheet, and payment of transaction-related taxes, which are estimated to be approximately US$750 million. Teck’s Board will determine the appropriate amount and form of a significant cash return to shareholders following closing of these transactions.

To support enhanced benefits to the Elk Valley, B.C. and Canada, Glencore has made commitments that will ensure, among other things, that:

- EVR will continue to operate in Canada through both a Vancouver head office and regional offices in Calgary, Alberta, and Sparwood, British Columbia, including completing the construction of a new Sparwood office.

- EVR will maintain significant employment levels in Canada with no net reduction in the number of employees in the business in Canada as a result of the transaction.

- EVR will increase capital expenditures in Canada such that they will amount to over CAD$2 billion (excluding deferred stripping) over three years.

- EVR will increase research and development activities in Canada to at least CAD$150 million over three years, including on innovation in relation to water quality treatment technologies – a 50% increase over current levels.

- EVR will increase its contributions to Canadian sponsorship, community and charitable programs.

- EVR will participate as a major funding partner up to CAD$15 million for the proposed renal/oncology addition to the East Kootenay Regional Hospital in Cranbrook.

- EVR will have a goal to become a nature positive business by conserving or rehabilitating at least three hectares for every one hectare affected by its mining activities going forward.

- EVR will develop and implement a climate transition strategy which will include medium term scope 1 and 2 emissions reduction targets, a long-term goal of net zero in respect of scope 1 and 2 emissions by 2050 as well as a commitment to work with partners towards an ambition to achieve net-zero Scope 3 emissions by 2050.

- EVR will honour the existing agreements between EVR and Indigenous Nations and will work with local Indigenous Nations to identify opportunities to increase participation in benefits from the activities of EVR.

Comments